- Insights

EUDI Wallet impact on financial industry: Benefits and use cases

Dec 5, 2025

ㅣ

Maïlys Mas

The financial industry operates under stringent AML regulatory compliance mandates when it deals with remote onboarding. The complexity of traditional identity verification, such as video calls or manual reviews to support these mandates, often results in significant customer loss: nearly one in two potential customers abandons the onboarding process due to poor user experience.

With eIDAS2.0, the early adoption of the EUDI Wallet gives financial institutions a clear first-mover advantage, starting with a smoother onboarding experience as well as additional benefits detailed below.

The financial industry main use cases and related pain points

Customer onboarding (KYC)

High abandonment at the identification step due to document and liveness capture issues, and step-heavy verification flows

High operational costs due to ID checks still relying on manual review, video calls introducing more delays, and possible errors

Multiple user journeys based on local regulator requirements

Fraud increase because of AI usage (synthetic identity, deepfake)

Loan applications (credit, lending, mortgages)

Repeated data verification (income, employment, residency…) for every new application increasing compliance workload

Slowed approval cycles and increased fraud exposure due to manual validation which is weak against AI-driven fraud

Payment authentication

High drop-off rates due to mandatory multi-factor authentication (to meet PSD2/SCA requirements) that users struggle to complete

Fraudulent payment attempts increase when authentication flows are weak or uneven across countries

Account recovery

High frictions for users and long delays due to asynchronous, multi-step recovery flows (document re-uploads, video calls, in-person meetings…), delaying access to services for hours or even days

Repeated identity re-verification forces users to overshare sensitive data, while increasing operational workload, support costs, and exposure to impersonation attacks

Looking at these use cases and constraints, the core challenges for financial institutions fall into four categories:

Core challenge categories | Description |

|---|---|

High onboarding drop-off | Remote onboarding in finance faces 40-60% abandon due to inefficiency and strict identification processes that are not convenient for users |

Complex compliance workload | Difficulties to align with evolving and heterogeneous regulations (from AML-D to the upcoming AML-R, and the PSD2/SCA to the future PSD3/PSR requirements) leading to heavy operational costs of $1,500–$3,000 per client |

Escalating fraud exposure | AI-driven fraud in the financial industry is projected to reach $58B by 2030 |

Cross-border expansion complexity | Entering a new market often requires new ID flows, new vendors, and navigating local compliance. At the same time, cross-border banking demand is rising as euro-area households’ pan-European deposits grew nearly 60% in 2024 (€151 billion), signaling more cross-border activity for national banks |

How the EUDI Wallet will impact the financial industry

The EUDI Wallet directly addresses the core challenges faced by financial institutions by replacing fragmented, document-driven verification with a high-assurance, government-grade and unified digital identity Wallet.

Its impact aligns precisely with the industry’s four major pain-point categories:

Better customer experience and higher conversion rates

Drop-off is a huge shortfall for financial institutions that can be fixed by improving the customer journey. In banking, according to Deloitte, “Digital Champions” differentiate themselves by proposing better user journey and mobile experience. That’s exactly what the EUDI Wallet offers as a solution.

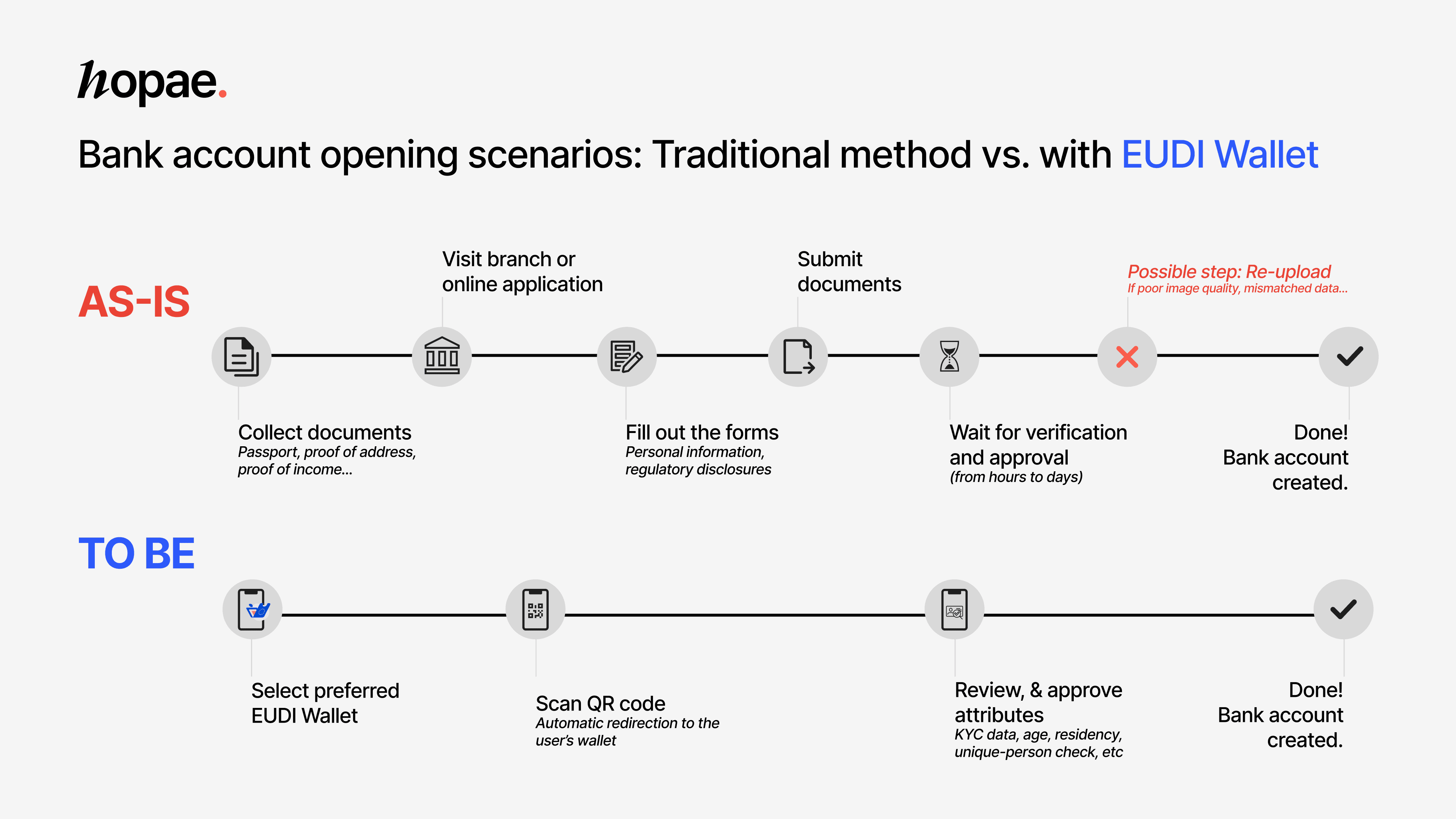

Example: Bank account opening with the EUDI Wallet

Replace document uploads and in-person or liveness checks, with instant Wallet-based ID verification → Drop the process from minutes, or sometimes even hours, to 30 seconds

Eliminates the repeated and oversharing data collection process to simplify the user experience → Switch from repetitive document uploads to a 3 click-journey

Harmonized, compliant onboarding

Compliance is a heavy burden for financial institutions. It is not just expensive, it also drains teams that need to navigate country-by-country rules and manual document reviews. The EUDI Wallet proposes an alternative that removes this complexity:

Stop collecting and analyzing countless documents (passport scans, proof of address…) → The EUDI wallet, providing High LoA, is already valid in most AML domestic directives, and will be as well in the new AML-R to come. It is an acceptable identification means for all financial institutions in all member states

Compliance comes built-in, as the EUDI Wallet aligns with AML, eIDAS, PSD2/SCA, PSD3/PSR requirements

Reduce onboarding costs with Wallet-based credentials → Shift from about €5 per verification (depending on countries) to only a few cents

Lower fraud exposure

Fraud is a growing threat for financial institutions that directly hurts profitability. The EUDI Wallet provides a simple, yet strong answer to counter AI-driven fraud (synthetic identities, deepfakes document tampering…):

Onboard users securely with the EUDI Wallet (via cryptographically signed credentials) → Remove the main fraud entry points (documents tampering)

Onboard users with government-grade Wallets that meet the highest security standards → Both the wallets and the enrollment flows are subject to an assessment from a certification assessment body to evaluate their security

Provide a high level of assurance to confirm the user’s claimed identity → The EUDI Wallet benefits from a High Level of Assurance, based on an enrollment relying on in-person identity proofing and the use of hardware tokens or smart cards

Limit fraudsters’ access to personal data by reducing exposure and oversharing → The EUDI Wallet is a decentralized identity, meaning data resides with the end-user so the risk of data breach is limited to an individual only and not to a centralized identity database. The Wallet also allows selective disclosure, meaning the end-user can limit the attributes he wants to share with Relying Parties (e.g. age instead of full date of birth)

Increase cross-border growth

Financial institutions increasingly serve users who move, work, invest, or borrow across multiple countries. Yet expanding internationally or accepting EU-wide foreigners still requires heavy adaptation of onboarding and identity checks. The EUDI Wallet unlocks a simpler, unified way to simplify this:

Accept users from any EU country through the same Wallet-based identity flow → Eliminate separate multi-onboarding paths for all jurisdictions

Verify foreign users’ ID with the same level of trust as domestic customers → Government-backed credentials ensure consistent assurance across borders

Automatically retrieve standardized, verifiable attributes across borders → Support risk checks (age, residency, unique personhood) without redesigning flows

Financial institutions unlock new opportunities with the EUDI Wallet

With the EUDI Wallet, financial institutions can not only consume the wallets but also enrich them with the issuance of Electronic Attestation of Attributes (EEA) and Qualified Electronic Attestation of Attributes (QEEA), making them fully part of the ecosystem. The EEA/QEEA can provide high-assurance credentials, streamline regulatory checks, and enable users to reuse verified data across services:

Instant and low friction SCA: as part of the Large Scale Pilot, banks and payment organizations are in the process of enabling SCA attestations, offering an alternative to their traditional SCA methods for online payment.

Deliver instant compliant eSignature for high-value contracts: The EUDI Wallet enables instant qualified eSignature, removing video identification (e.g. a loan agreement can be signed instantly and remotely) fastening the entire process.

Faster lending decisions and more reliable risk scoring: EEA/QEEA allow banks to verify income, address, or employment in seconds. It also enables them to issue

Issue verifiable credentials and unlock new business model opportunities: Financial institutions can issue their own attestations so customers can reuse bank-verified data across partner services (e.g. bank details/IBAN for the lending industry) generating potential new revenue streams.

→ For example: a bank could issue an affordability credential directly to the user’s wallet, which a telco or gambling operator could then request and use to ensure users can access their services.

The EUDI Wallet can help financial services convert more users and cut compliance costs

The EUDI Wallet not only addresses compliance issues. It also solves what current verification methods face: fragmented checks, high drop-off, rising fraud, and inconsistent cross-country requirements. By introducing a unified, government-backed identity layer, financial institutions can reduce friction, simplify compliance, lower verification costs, and welcome users across Europe through a single, trusted flow. It also opens the door for banks to issue their own high-assurance credentials and participate in a broader ecosystem where verified data moves securely. The shift is coming. Those who adopt early will lead it.

Hopae, the global digital identity infrastructure company, enables you to:

Onboard users from any EU market through a single integration, enabling EUDI Wallet verification in one click, while also supporting worldwide eIDs and wallets.

issue EEA/QEEA that users can reuse across services, including SCA Attestations.

Hopae provides one platform to verify, issue, and scale identity across Europe. Request a consultation.

- Newsletter

Be the first to know about cutting-edge IDV developments,

Hopae's latest white papers and reports, and industry breakthroughs.